work opportunity tax credit questionnaire social security number

Johnson Service Group Inc Position. Know where you stand with access to your 3-bureau credit scores and report.

I dont feel safe to provide any of those information when Im just an applicant from US.

. Below you will find the steps to complete the WOTC both ways. A complete IRS Form 8850 Pre-Screening Notice and Certification Request for the Work Opportunity Credit. The owners of the site is Walton management services and it says our company is participating in a federal jobs tax credit program called the work opportunity tax credit program.

There are two sets of frequently asked questions for WOTC customers. The Work Opportunity Tax Credit WOTC is a federal tax credit that the government provides to private-sector businesses for hiring individuals from nine target groups that have historically faced significant barriers to employment. If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow.

For the work opportunity credit. This weeks question came from an employee. Certifications to employers seeking a Work Opportunity Tax Credit WOTC.

Decide on what kind of signature to create. Companies hiring long-term unemployed workers receive a tax credit of 35 percent of the first 6000 per new hire employee earned in monthly wages during the first year of employment. If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow.

Correcting Your Completed Forms. A typed drawn or uploaded signature. Work Opportunity Tax Credit WOTC is a program that provides federal tax.

This tax credit program has been extended until December 31 2025. If the eligible employee works fewer than 400 hours but at least 120 hours the employer may claim a credit equal to 25 of the eligible employees wages. 116-260 -- Consolidated Appropriations Act 2021.

I am a member of a family that has received assistance from Temporary Assistance for Needy Families TANF for any 9. To apply for the Work Opportunity Tax Credit employers must submit the following. For most target groups WOTC is based on qualified wages paid to the employee for the first year of employment.

Create your signature and click Ok. Update as of December 19 2015. Learn More about Premier.

The Work Opportunity Tax Credit is a federal tax credit available to employers who hire and retain qualified veterans and other individuals from target groups that historically have faced barriers in securing employment. Find answers to Do you have to fill out Work Opportunity Tax Credit program by ADP. My mom wont give me my social security number because she doesnt trust the site.

Work Opportunity Tax Credit Questionnaire. Its asking for social security numbers and all. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef.

Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. The tax credit amount under the WOTC program depends on employee retention. Employers may meet their business needs and claim a tax credit if they hire an individual who is in a WOTC.

At CMS as Work Opportunity Tax Credit WOTC experts and service providers since 1997 we receive a lot of questions via our website. Follow the step-by-step instructions below to design your ROTC questionnaire. Questions and answers about the Work Opportunity Tax Credit Online eWOTC service.

After the required certification is secured taxable employers claim the WOTC as a general business credit against their income taxes and tax-exempt employers claim the WOTC against their payroll taxes. The forms require your identifying information Social Security Number to confirm who you are and they ask for your date of birth because some of the target groups are based on age. There are three variants.

WOTC is authorized until December 31 2025 Section 113 of Division EE of PL. The Work Opportunity Tax Credit WOTC program is a federal tax credit available to employers if they hire individuals from specific targeted groups. Take control with a one-stop credit monitoring and identity theft protection solution from Equifax.

As of 2020 the tax credit can save employers up to 9600 per employee with no limit on the number of employees hired from. Employers receive substantial tax credits for hiring certain applicants under the Work Opportunity Tax Credit. One of my favorite tax credit programs if there ever was a thing as favorite tax credits is the Work Opportunity Tax Credit or WOTCUnfortunately the DOL hasnt updated their website to discuss some of the recent.

Completing Your WOTC Questionnaire. Uncover potential fraud with credit monitoring and alerts. A company hiring these seasonal workers receives a tax credit of 1200 per worker.

This government program offers participating companies between 2400 9600 per new qualifying hire. Questions and answers about the Work Opportunity Tax Credit program. The employers share of Social Security tax under IRC Section 3111a 62 of wages.

The credit to for-profit employers is 25 of qualified first-year wages for those employed at least 120 hours but fewer than 400 hours and 40 for those employed 400 hours or more. Select the document you want to sign and click Upload. Number of Views 139K.

By creating economic opportunities this program also helps lessen the burden on other government assistance programs. Faced barriers to employment. Your employer will provide the WOTC forms to you online or on paper as part of your onboarding new hire paperwork.

This tax credit is for a period of six months but it can be for up to 40. The Retention Credit is subject to a number of rules to prevent double-dipping. If you do not supply the social security number on the application you will likely have to make a trip to the company to fill it in if the employer wants to offer you a job.

Social security number. Updated on September 14 2021. A complete ETA Form 9061 Individual Characteristics Form ETA Form 9062 Conditional Certification provided to the job seeker by TWC or a participating agency may be submitted in.

The WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently. And people who receive Supplemental Security Income payments. Number of Views 29871K.

The WOTC forms are federal forms to help determine if you will make your employer eligible for a tax credit when they hire you. An employers deduction for wages must be reduced by the amount of the Retention Credit. Even the US Postal Service is not always the safest way to transmit information With all of the new laws about guarding.

Dont email such sensitive information. TAX CREDIT QUESTIONNAIRE Company. The employee groups are those that have had significant barriers to employment.

An employer may claim a credit equal to 40 of the eligible employees qualified wages if the eligible worker works at least 400 hours during the first year of employment. Services and it says our company is participating in a federal jobs tax credit. Check here if any of the following statements apply to you.

President Promptly Signs Government Funding and Tax Extenders Legislation WOTC Survives through 2019. Help monitor your credit and Social Security number. Get answers to your biggest company questions on Indeed.

Pdf Survey Of Green Bond Pricing And Investment Performance

Pdf Life Insurance Purchase Behavior A Systematic Review And Directions For Future Research

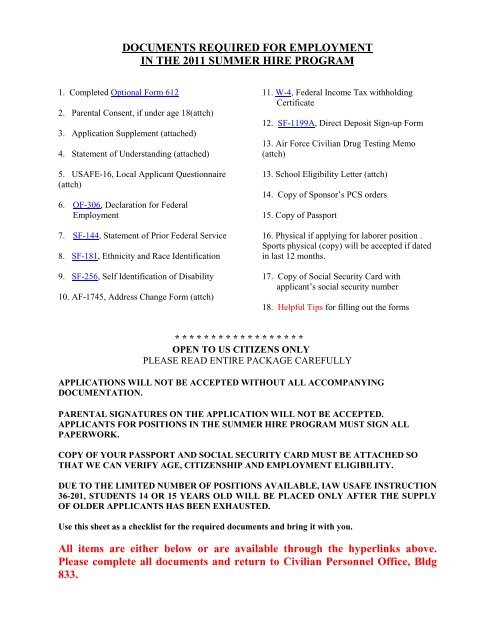

Documents Required For Employment In The 2011

Leo Work Opportunity Tax Credit

Leo Work Opportunity Tax Credit

Adp Introduces Mobile Tax Credit Screening For Work Opportunity Tax Credit

How Your Business Can Apply For The Work Opportunity Tax Credit Wotc

Pdf Effects Of The Covid 19 Lockdown On The Livelihood And Food Security Of Street Food Vendors And Consumers In Nigeria

Pdf The Importance Of Social Securitity Benefits To The Income Of The Aged Population

Wotc Questions Do I Have To Fill Out The Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts

/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)

Form 2441 Child And Dependent Care Expenses Definition

Federal Wotc And Local Tax Credit Assistance Maximus Tces

Talent Report Employment Equifax Workforce Solutions

How Your Business Can Apply For The Work Opportunity Tax Credit Wotc

/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)